Frequently Asked Questions - Social Security & SSI Disability

What Is Social Security Disability?

What Is Social Security Disability?

Social Security disability is a common term that includes two types of benefit programs payable if an adult or a child is disabled - Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). Adults can simultaneously qualify for both SSDI and SSI benefits. Additional SSDI benefits may be paid to an adult if they have family members who are financially dependent on them. Disabled children cannot receive SSDI benefits based on their own disability. Disabled children can receive SSI disability benefits regardless of whether the parent is disabled.

What Is SSDI?

What Is SSDI?

Adults - SSDI is a disability program available to you, an adult, if you satisfy the following criteria:

- You satisfy the non-disability criteria by obtaining disability insured status (you have worked and earned a qualifying number of Social Security "credits") - Non-Medical Criteria: Social Security Disability & SSI Benefits;

- You are not yet full retirement age which is 65-67 (full retirement age depending on year born - Retirement Age);

- You satisfy the adult disability criteria (you are disabled) - Adult Social Security Disability Criteria: 5-Step Evaluation Process);

- You have been disabled for 5 full consecutive months; and

- You apply while disabled or no later than 12 months after the month your disability ended - Applications).

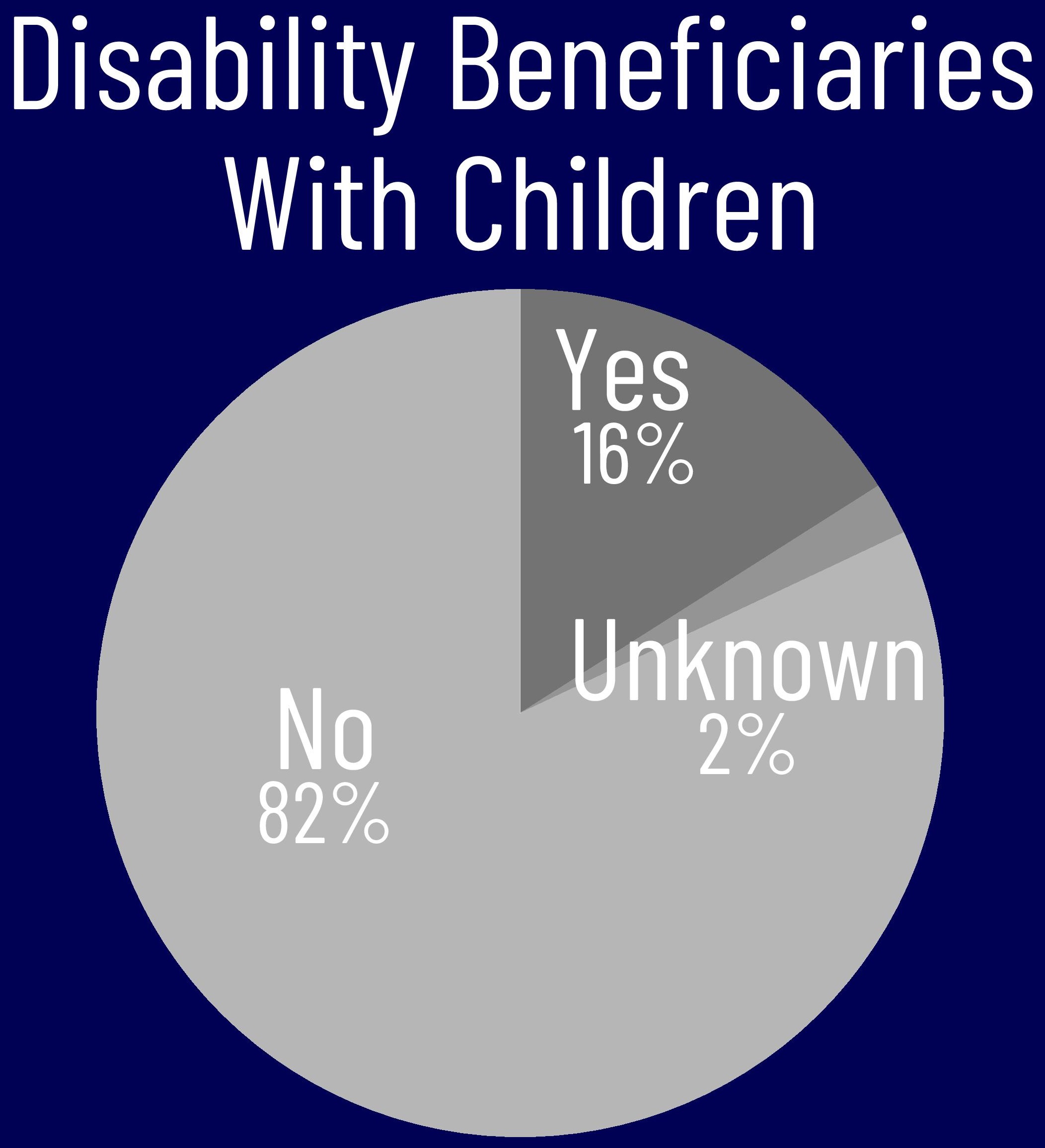

Children - Your disabled child cannot get SSDI disability benefits, but if you are disabled, and you receive SSDI benefits, you can get SSDI dependent benefits for your child.

What Is SSI?

What Is SSI?

SSI is a needs-based disability program (welfare) available to you, a disabled adult, and your disabled children.

Adults - You, an adult, are eligible for SSI if you satisfy the following criteria:

- You satisfy the Non-Medical Criteria: Social Security Disability & SSI Benefits:

- You have limited income and deemed income;

- You have limited resources and deemed resources;

- You are a United States (U.S.) citizen or national (resident of American Samoa or the Northern Mariana Islands), or a certain alien (a foreigner from another country who is not a U.S. citizen or a U.S. national);

- You are a resident of the U.S. including the District of Columbia, American Samoa, and the Northern Mariana Islands;

- You are a resident if you live there with the intent to continue living there;

- You are a resident if you are a child living with a parent in the military service assigned to permanent duty outside of the U.S.; or

- You are a resident if you are a student temporarily abroad as part of an educational program;

- You are not absent from the country for a full calendar month or 30 consecutive days or more;

- You are not confined to an institution (such as a hospital, jail, or prison) at the government's expense;

- You do not have an unsatisfied felony or warrant for an escape from custody, flight from prosecution/confinement, or flight/escape;

- You satisfy the Adult Social Security Disability Criteria: 5-Step Evaluation Process;

- You apply for any other cash benefits or payments for which you may be eligible; and

- You apply.

Children - Your child is eligible for SSI if they satisfy all the adult eligibility criteria listed above, except that your child's disability is evaluated under different criteria - Child Social Security Disability Criteria: 3-Step Eval. Process, and your child also satisfies the following:

- Your child is not married or head of household, and

- Your child is under age 18 or under age 22 and a high-school student.

What Does "Disability" Mean For Adults?

What Does "Disability" Mean For Adults?

You must satisfy the five-step sequential evaluation process in one of two ways: you satisfy steps one, two and three; OR you satisfy steps one, two, four, and five. The five-step process is as follows:

- You are not performing "substantial gainful activity" (SGA) and you meet the DR,

- Your impairment is "severe,"

- You "meet" or "equal" a listing,

- You cannot perform your "past relevant work," and

- You cannot perform "other work."

A full discussion is available here - Adult Social Security Disability Criteria: 5-Step Evaluation Process

If you are statutorily blind, different disability criteria rules apply - Statutory Blindness Disability Criteria

If you are a widow or widower, different disability criteria rules apply - Widow/Widower: Criteria & Benefits

What Does "Disability" Mean For Children?

What Does "Disability" Mean For Children?

Your child must satisfy the three-step sequential evaluation process as follows:

- Your child is not performing "substantial gainful activity" (SGA) and meets the durational requirement (DR),

- Your child's impairment is "severe," and

- Your child "meets," "medically equals," or "functionally equals" a "listing."

A full discussion is available here - Child Social Security Disability Criteria: 3-Step Eval. Process

What Evidence Do I Need To Prove Disability?

What Evidence Do I Need To Prove Disability?

You bear the burden of proving your disability. You must have evidence proving you are disabled. Knowing what evidence you must submit and how Social Security evaluates your evidence is critically important - Submitting Winning Evidence & What Social Security Needs.

What Are The SSDI/SSI Benefits?

What Are The SSDI/SSI Benefits?

Monthly Payments

Monthly Payments

SSDI - The SSDI monthly amount is based on how much a person has paid in Social Security taxes. The average 2020 SSDI individual monthly amount is $1,258. The average 2020 SSDI family maximum is $2,176. SSDI Amounts.

SSI - The federal SSI monthly amount in 2020 is $783 per individual and $1,175 per couple - Federal SSI Amount. All states except Arizona, Mississippi, North Dakota, Northern Mariana Islands, and West Virginia pay a supplement in addition to the federal amount (usually about an additional $25-$75).

Back pay

Back pay

SSDI - SSDI back pay is your accrued monthly benefit amount. It starts, at the earliest, from whichever date is later - 1) 17 months before the date you apply for benefits, or 2) your alleged onset date (the date you allege disability) and ending the date you are finally paid benefits. However, Social Security imposes a five full-month waiting period on you which means your benefits start five full-months after either of the two above starting dates. Your SSDI backpay is paid in one lump sum.

SSI - SSI back pay is the accrued monthly benefit amount starting, at the earliest, from the date you apply for benefits and ending the date you are finally paid. Backpay is generally paid in three installments six months apart.

Medical Insurance

Medical Insurance

Medicare - Medicare is medical insurance. If you are entitled to SSDI benefits, you will receive Medicare. Medicare is a national medical insurance program administered by the United States government through private insurance companies. Medicare requires that you pay monthly premiums and co-pays. To receive Medicare, you must wait 24 months. This 24-month waiting period starts after your five-month waiting period.

Medicaid - Medicaid is medical insurance. If you are entitled to SSI benefits, you will receive Medicaid. Medicaid is a medical insurance program administered jointly by the United States government and individual states. There are usually no costs to the recipient.

Earnings Freeze

Earnings Freeze

The earnings freeze is related to your retirement benefits. When Social Security determines your monthly retirement amount, it considers all your adult years of earnings. If you have years of no earnings, this will reduce your monthly retirement amount. If you have years of no earnings, and you were determined by Social Security to be disabled in those years, Social Security does not include those no-earnings years when it calculates your monthly retirement benefit - the earnings freeze. Hence, your retirement benefits are higher.

A full discussion is available here - Your Benefits: Social Security Disability & SSI

Can My Other Family Members Get Benefits Because I Am Disabled?

Can My Other Family Members Get Benefits Because I Am Disabled?

SSDI

SSDI

Yes. If you receive SSDI benefits, certain family members can receive monthly benefits and back pay, but not Medicare, if your family members are financially dependent on you and meet other requirements. Your family member's benefits will not reduce your benefit. You are subject to a family maximum benefit amount payable on your record. Your family members can receive up to an additional 50% of your benefit amount (any divorced spouse's benefit or widow/widower's amount does not count against your family maximum). If you have multiple qualifying family members, they split the family benefit amount equally. For example, if you receive $1,200 per month in disability benefits, your qualifying child will receive $600 per month in dependent's benefits (a child gets 50% of your monthly amount). If you have three qualifying children, the three children will each receive $200 per month in dependent's benefits. The family members that may be entitled to SSDI dependent benefits and the benefit amounts are as follows:

- Child - 50% of your monthly amount for each child,

- Spouse - 50% of your monthly amount,

- Divorced Spouse - 50% of your monthly amount,

- Parent - 82.5% of your monthly amount for one parent and 75% each for more than one parent, and

- Widow/Widower - 100% of your monthly amount.

A full discussion is available Here - Your Family's Benefits: Social Security Disability & SSI

SSI

SSI

No. If you receive SSI benefits, your family members are not entitled to family member benefits.

What is The Process And How Long Does The Process Take?

What is The Process And How Long Does The Process Take?

There are five adjudication levels:

- Application/Initial Level - three to five months for a decision. If you are denied, you can appeal and request Reconsideration.

- Reconsideration Level - three to five months for a decision. If you are denied, you can appeal and request a hearing.

- Hearing Level - 12-16 months for a hearing. Then add another two to four months for a decision to be written and issued. If you are denied, you can appeal and request Appeals Council review.

- Appeals Council Level - 12-18 months for a decision. Then add another 12-16 months because, in nearly all successful appeals, the case will be sent back for another hearing. If you are denied, you can appeal and request federal court review.

- Federal Court Level - 12-18 months. If you are denied, you can appeal up to the United States Supreme Court.

If you are awarded benefits, the payment process will be about another 30-90 days for your payment to be processed. Then add about another 30-90 days for your dependent's payment to be processed.

A full discussion is available Here - Application & Appeals Process - Social Security Disability

I've Been Denied. Now What?

I've Been Denied. Now What?

You need to appeal and/or file a new application for benefits. You nearly always have 65 days to appeal (30 days in rare situations).

What Happens At A Hearing?

What Happens At A Hearing?

A hearing is casual. It is held at a Social Security Administration Hearings Office. It is conducted in a conference room around a conference table. It is presided over by a Social Security Administrative Law Judge (ALJ). Those present include the ALJ, you, a hearing recorder (a person), your attorney (if you have one), a vocational expert [(VE) if it is an adult case], and sometimes a medical expert (ME).

There are essentially two parts to the hearing. First, the ALJ or your attorney (if you have one) will ask you questions - generally in two categories: 1) how you spend your time/live your life, and 2) what are your abilities and limitations. Second, the ALJ will ask questions of the VE about work-related matters (if one is present) and of the ME about medical-related matters (if one is present). The hearing will take about an hour, and decisions are usually made after the hearing and sent to you in the form of a written decision.

A full discussion is available Here - Hearings & Social Security Disability Benefits

What Are The Chances of Being Awarded Benefits?

What Are The Chances of Being Awarded Benefits?

Social Security's nationwide award rates are as follows (rates will vary based on your individual Social Security office at the initial and reconsideration levels and your administrative law judge at the hearing level):

- Initial Level (latest data is 2016) - 44.4% allowance rate for SSDI only claims, 22.4% for SSDI/SSI joint claims, 10.4% for SSI only claims, and a 35% overall allowance rate.

- Reconsideration Level (latest data is 2016) - 10.9% allowance rate for SSDI only claims, 7% for SSDI/SSI joint claims, 28.4% for SSI only claims, and a 9% overall allowance rate.

- Hearing Level (this data is 2016 although more recent data can be calculated) - 56.2% allowance rate for SSDI only claims, 38.5% for SSDI/SSI joint claims, (there is no data for SSI only claims), and a 48.8% overall allowance rate.

- Appeals Council Level (AC) (latest data) - 12.1% remand rate.

- Federal District Court (Court) (latest data) - About a 49% remand rate.

At the AC and Court levels, a favorable appeal nearly always means your case is remanded (sent back) to the hearing office for a new hearing. Rarely, the AC or Court will issue a decision finding you disabled.

Specific data is published by the Social Security for SSI child's claims as follows:

- Initial Level (latest data) - 46.9% allowance rate.

- Reconsideration Level (latest data) - 14% allowance rate.

How Long Will I Receive Disability Benefits?

How Long Will I Receive Disability Benefits?

Your disability benefits will continue until Social Security determines you are no longer disabled; that is, you are capable of full-time work. The reasons include, but are not limited, to the following:

- You successfully return to work,

- Your medical records show your medical condition and symptoms have improved indicating you can perform full-time work,

- Your activities of daily living show your medical condition and symptoms have improved indicating you can perform full-time work, and/or

- You do not cooperate with Social Security.

What if I Work While I'm Waiting For My Disability Benefits?

What if I Work While I'm Waiting For My Disability Benefits?

Your return will either be unsuccessful which Social Security will ignore or successful which will affect your ability to get disability benefits. You will need to document your return to work.

Unsuccessful Work Attempt (UWA)

Unsuccessful Work Attempt (UWA)

There are two types of UWAs. First, you return to work, and you do not make substantial gainful activity (SGA) which is currently $1,260 per month - SGA Amounts.

Second, you return to work, and you meet the following criteria:

- You worked making SGA or more,

- You worked six months or less, and

- You stopped work because of your medical condition or because special conditions were removed that took into account your medical condition and the removal of those special conditions either forced you to stop working or to reduced your amount of work so that your earnings fell below SGA.

Social Security will not count an UWA against you. Your case will continue as if you had not engaged in the UWA. You can keep your earnings from working. Your UWA will almost always improve your credibility because it shows your desire to work.

Successful Work Effort

Successful Work Effort

If you return to work making SGA for more than six months, Social Security will determine your return to work to be successful. A successful work effort creates four issues. First, for the months you engaged in your successful work effort, you will not be found disabled and you cannot get disability benefits. Second, your successful work effort may cause you to not satisfy the durational requirement which is a time period you must be disabled to received disability benefits. Third, your successful work attempt may establish that you are not now nor were you ever disabled. Fourth, you may be entitled to a closed period. A closed period is a situation where you are not now disabled, but you were for a time period that met the durational requirement.

A full discussion is available Here - How Working Affects Your Social Security/SSI Disability Case

What If I Go to School While My Case Is Pending?

What If I Go to School While My Case Is Pending?

If you are an adult, and you attend school while your Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) case is pending, Social Security will evaluate five factors:

- What type of school are you attending,

- How long you attended school,

- How many classes you are taking,

- How much homework you do, and

- Whether you got good grades and/or graduated.

The primary issue for all five factors is whether your school attendance is/was unsuccessful which Social Security will most likely ignore or successful which will affect your ability to obtain disability benefits. Either way, you will need to document the details of your school attendance.

A full discussion is available Here - Going To School And A Social Security & SSI Disability Case

Are Benefits Taxable?

Are Benefits Taxable?

SSI

SSI

SSI benefits are not taxable.

SSDI

SSDI

State Tax - Thirteen states tax Social Security disability benefits: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Rhode Island, Utah, Vermont and West Virginia.

Federal Tax - Your SSDI benefits may subject to federal tax. Whether you owe federal taxes is primarily based on your total household income - Social Security disability benefits, other Social Security benefits (if any), spouse's earnings (if any and you are filing jointly) unemployment benefits (if any), interest (if any), dividends (if any), etc. The higher your household income, the more likely your Social Security disability benefits will taxed.

Your federal tax liability is as follows:

- No tax liability if the claimant's adjusted gross income is less than $25,000 as an individual or $32,000 if married and filing jointly.

- Fifty percent of benefits are taxed if the claimant's adjusted gross income is between $25,000-$34,000 as an individual or $32,000-$44,000 if married and filing jointly. Your actual tax rate will depend on your income amount. For example, 50% of your benefits may be taxed at 10%, 15%, or 20%, etc.

- Eighty-five percent of SSDI benefits are taxable if annual adjusted gross income exceeds $34,000 for an individual or $44,000 if married and filing jointly. Again, your actual tax rate will depend on your income amount. For example, 85% of your benefits may be taxed at 10%, 15%, or 20%, etc.

A full discussion is available Here - Filing Taxes On Social Security & SSI Disability Benefits

Let Us Help You Find A Qualified Local Disability Attorney

"One of the first and most critical goals of a disability attorney is to discuss with the client the disability standard the client will face. This knowledge will direct how the entire case will proceed."