Adult Social Security Disability Non-Medical Criteria - SSDI & SSI

Overview

Overview

Before Social Security determines your medical condition, and your symptoms and limitations, it will first determine if you meet either its Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) non-disability criteria. SSDI non-disability criteria is based on working, paying taxes, and earning Quarters of Coverage (QC)s. SSI non-disability criteria is based on limited income and resources (assets), citizen or alien requirements, and a few other criteria. The evaluation of income and resources is complex. The citizen evaluation is easy. The alien evaluation is complex. You can qualify for both SSDI and SSI at the same time.

Know To Win

- Non-Medical Criteria

- Disability Criteria

- Medical Conditions

- Functional Limitations

- Submit Winning Evidence

SSDI Non-Medical Criteria

SSDI Non-Medical Criteria

General

General

The SSDI non-disability criteria is as follows:

- You are not yet Full Retirement Age which is 65-67 (full retirement age depending on the year you're born);

- You have been disabled for 5-full consecutive months;

- You apply while disabled or no later than 12 months after the month your disability ended - Application/Initial Level, and

- You obtain disability insured status;

Disability Insured Status

Disability Insured Status

General. To obtain disability insured status, you must earn QCs so that you are both 1) fully insured, and 2) insured for disability. When you apply for benefits, Social Security will determine your insured status.

Quarters of Coverage. You obtain fully insured and disability insured status by earning a required number of QC's. A QC is a unit based on an amount of money you earn in a period of time either through employment or self-employment. Prior to 1978, the period of time a QC was based upon was a quarter of a year as wages were reported on a quarterly basis. Hence, the term "quarter of coverage." You could earn a maximum of one QC per quarter - four QC's per year. After 1977, wages and self-employment income were reported on an annual basis, and Social Security stopped crediting QC's based on money earned within a quarter and instead began crediting QC's based on total money earned within a taxable year. In 2020, you earn a QC for every $1,410 earned up to a maximum of four QC's.

Fully Insured Status. You must meet one of four fully insured status criteria.

Criteria One - You must acquire one QC for every year after your 21st birthday. You need at least six QCs but not more than 40.

Criteria Two - You acquire 40 QC's.

Criteria Three - This method is rare - you are eligible for survivor's benefits, and you file on the earnings record of your deceased parent who died fully insured.

Criteria Four - This method is no longer relevant.

Disability Insured Status. You must meet one of four disability insured status rules.

Rule I - At the time you allege disability, you earned at least 20 QCs in the preceding 40-quarter period - the 20/40 rule. In other words, you worked five of the last 10 years (5 yrs. x 4 qtrs. = 20, and 10 yrs. x 4 qtrs. = 40). This is the most common way one meets the disability insured status criteria.

Rule II - You become disabled before age 31, you have earned QCs in at least one-half of the total quarters from age 21 to 31, and you have earned at least six QCs.

Rule III - You become disabled at age 31 or older, you had a prior period of disability which began before age 31 and you were only insured under for this prior period of disability according to Rule II, you have earned QCs in at least one-half of the total quarters from age 21 to the most recent period of disability, and you have earned at least six QCs.

Rule IV - You are Statutory Blind.

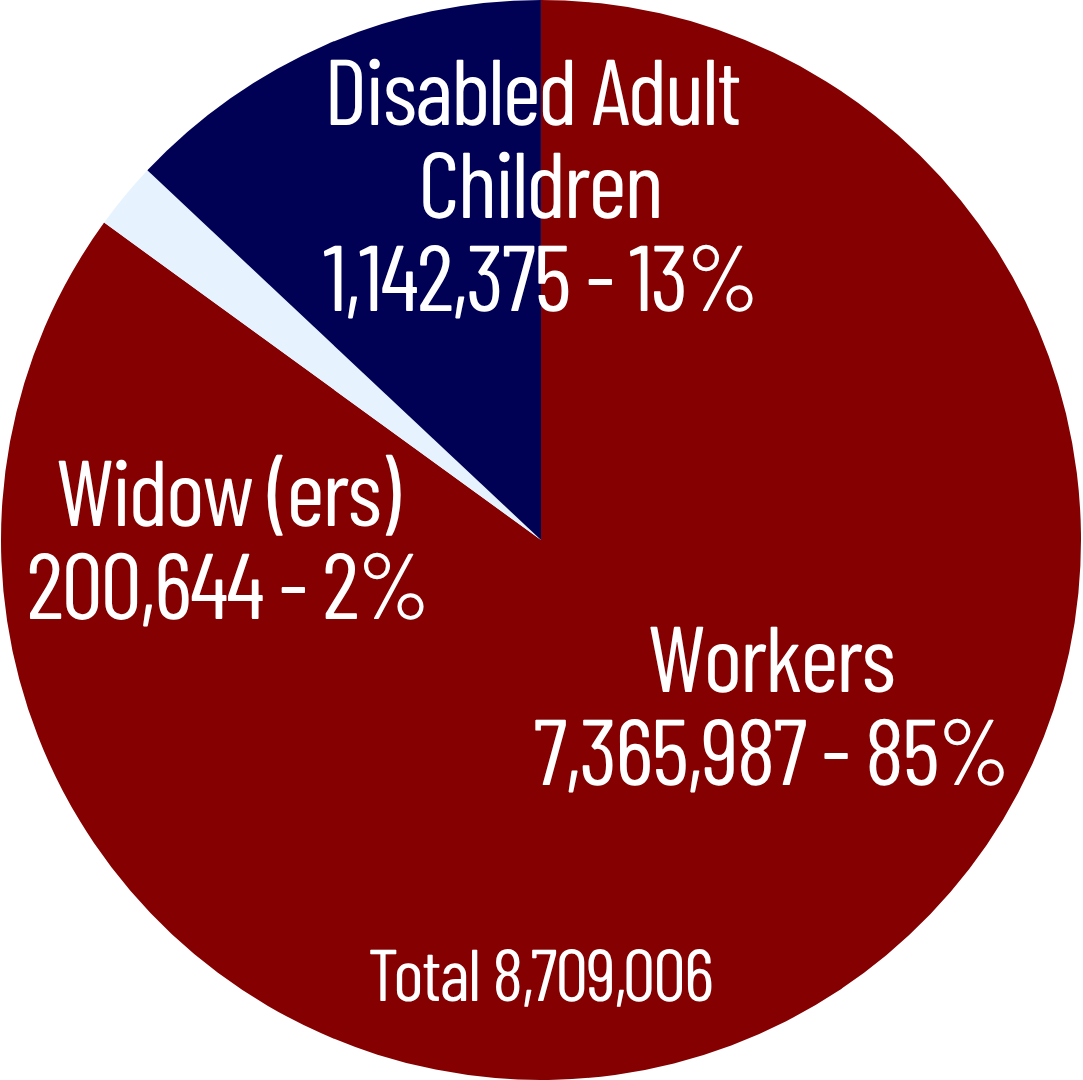

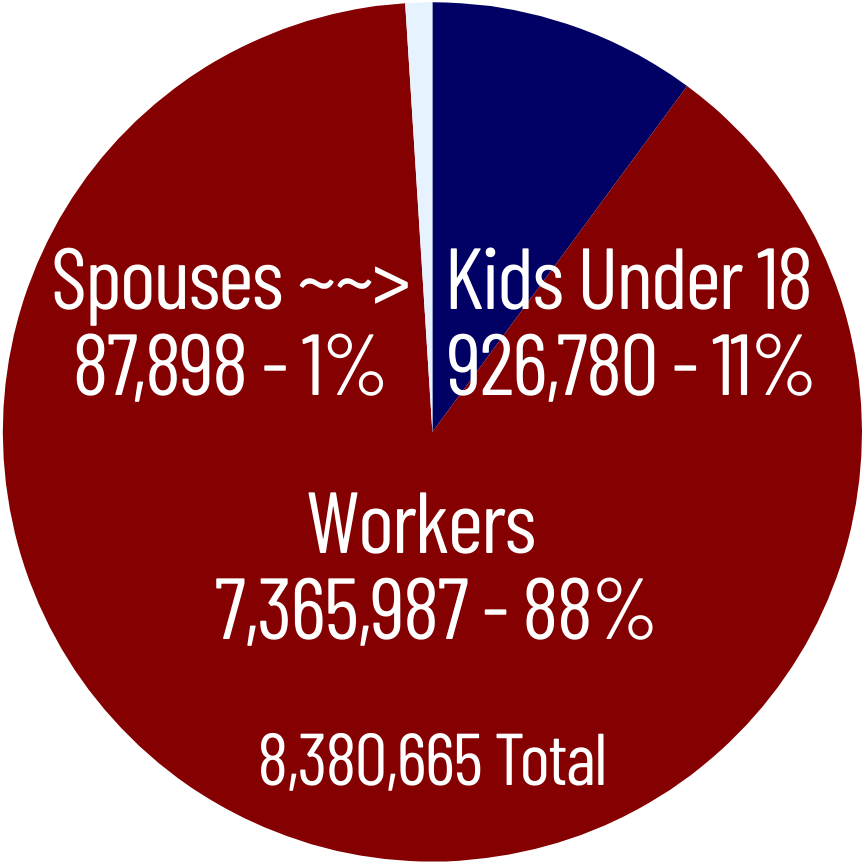

2023 Report on the SSDI Program

& Paid Non-Disabled Dependents

2023 Report on the SSDI Program

SSI Non-Disability Criteria

SSI Non-Disability Criteria

General

General

Adult. If you are a disabled adult, you are eligible for SSI if you meet the following criteria:

- You have limited resources and deemed resources (another person's resources that are counted as your resources);

- You have limited income and deemed income; (another person's income that is counted as your income);

- You are a United States (U.S.) citizen or national (resident of American Samoa or the Northern Mariana Islands), or a certain alien (a foreigner from another country who is not a U.S. citizen or a U.S. national);

- You are also a U.S. resident including the District of Columbia, American Samoa, and the Northern Mariana Islands,

- You are a resident if you live there with the intent to continue living there,

- You are a resident if you are a child living with a parent in the military service assigned to permanent duty outside of the U.S., or

- You are a resident if you are a student temporarily abroad as part of an educational program;

- You are not absent from the country for a full calendar month or 30 consecutive days or more;

- You are not confined to an institution at the government's expense (such as a hospital, jail, or prison) ;

- You do not have an unsatisfied felony or warrant for an escape from custody, flight from prosecution/confinement, or flight/escape; and

- You apply.

Child. If you have a disabled child, your child is eligible for SSI if you and your child meet all the conditions for adult non-disability criteria requirements and your child meets the following criteria:

- Your child is not married or head of household; and

- Your child is under age 18, or under age 19 and a high-school student, or over age 18 with a disability that began before age 22.

Resources

Resources

Types of Resources. There are two types of resources: 1) your resources which are resources you own, and 2) deemed resources which another person owns that the Social Security counts as your resources.

Social Security will determine your resources and your deemed resources. It will then "count" (include) some resources and "not count" (ignore) some resources. If your counted resources are over $2,000 as an individual or $3,000 as a couple, you will not be eligible for adult SSI benefits, and your child will not be eligible for child SSI benefits.

Resources Counted. Social Security counts the following resources:

- Cash,

- Bank Accounts,

- Stocks,

- Bonds,

- 401ks

- Life insurance

- Bare land,

- More than one vehicle if single or more than two vehicles if married,

- Personal property [jewerly (except wedding rings), motorcyles, motorhomes, etc.], and

- Anything else of value that can be converted to cash.

Resources Not Counted. Social Security does not count the following resources:

- The home you live in and the land your home is on;

- Household goods and personal effects (e.g., your wedding and engagement rings);

- Burial plots for you or your immediate family;

- Burial funds for you and your spouse ($1,500 value or less);

- Life insurance policies ($1,500 value or less);

- One vehicle if single or two vehicles if married;

- SSI or Social Security back pay for up to nine months after you receive each installment;

- Grants, scholarships, fellowships, or gifts set aside to pay educational expenses for nine months after you receive them;

- Up to $100,000 in an Achieving a Better Life Experience (ABLE) account established through a state ABLE program;

- Property essential to self-support;

- Resources a disabled or blind person needs for an approved plan for achieving self-support (PASS);

- Money saved in an Individual Development Account (IDA);

- Support and maintenance assistance and home energy assistance that Social Security does not count as income;

- Cash received for medical or social services that Social Security does not count as income (this is only not a resource for one month);

- Health flexible spending arrangements (FSAs);

- State or local relocation assistance payments (this is not a resource for 12 months);

- Crime victim's assistance (this is not counted for nine months);

- Earned income tax credit payments (this is not counted for nine months);

- Dedicated accounts for disabled or blind children;

- Disaster relief assistance;

- Cash received to replace a resource (a house, car, oven, etc.) that is lost, damaged, or stolen (this is not counted for nine months);

- Federal tax refunds and advanced tax credits (this is not counted for 12 months);

- The first $2,000 of compensation received per calendar year for participating in certain clinical trials;

- Some trusts; and

- No more than a $100,000 in a qualified Achieving a Better Life Experience (ABLE) account.

Deemed Resources (Counted). Social Security will consider this counted resources for both adult and child applicants:

- Spouse's resources (noted above); and

- You/your child are an alien with a sponsor who owns resources (there are a few exceptions).

Income

Income

Types of Income. Social Security classifies your income in three categories: 1) your income which you earn from paid work - earned income [e.g., wages, salaries, tips, etc.); 2) your income which you earn from non-work - unearned income; and 3) deemed income which another person earns that the Social Security counts as your income.

If you have no earned, unearned, or deemed income, you obviously satisfy the income requirement. If you have earned, unearned, or deemed income, Social Security will then "count" (include) some income and "not count" (ignore) some income. If you have counted income, you can still receive SSI benefits, but your SSI benefits will be reduced because of your income.

Earned Income Counted. This includes income from your work activity.

Unearned Income Counted. Unearned Income for both adult and child applicants includes essentially any monies given to you by anther person or entity. Examples include the following:

- Money, gifts, or favors from friends or family (this includes free rent and food);

- State disability payments;

- Child support;

- Pensions;

- Unemployment benefits;

- Veterans Affairs benefits;

- Unemployment benefits; and

- Investments.

Deemed Income Counted. Deemed Income for both adult and child applicants includes:

- Spouse's income; and

- You/your child are an alien with a sponsor who earns income (there are a few exceptions).

Earned, Unearned, and Deemed Income Not Counted. Social Security will count some of your income. Income that is not counted is as follows:

- The first $20 of unearned income received in a month;

- The first $65 of earned income;

- One-half of unearned income after the $20 exclusion;

- Food stamps;

- Income tax refunds;

- Home energy assistance;

- Assistance based on need funded by a state or local government, or a Native American tribe;

- Small amounts of income received;

- Interest or dividends earned on countable resources or resources excluded under other federal laws;

- Grants, scholarships, fellowships or gifts used for tuition and educational expenses;

- Food or shelter based on need provided by nonprofit agencies;

- Loans to you (cash or in-kind) that you have to repay;

- Income set aside under a Plan to Achieve Self-Support (PASS);

- Earnings up to $1,820 per month to a maximum of $7,350 per year (effective January 2018) for a student under age 22;

- The cost of impairment-related work expenses for items or services that a disabled person needs to work;

- A blind person's cost of work expenses;

- Disaster assistance;

- The first $2,000 of compensation received per year for participating in certain clinical trials;

- Refundable Federal and advanced tax credits received on or after January 1, 2010; and

- Certain exclusions on Native American trust fund payments paid to Native Americans who are federally recognized tribe members.

How Your Income Affects Your SSI Monthly Benefit Amount

How Your Income Affects Your SSI Monthly Benefit Amount

Earned income and deemed income reduces your SSI benefit amount one dollar for every dollar received except for the first $85 dollars received. Unearned income reduces your SSI benefit amount one dollar for every two dollars received. If you are receiving SSI benefits, and you have earned, unearned, or deemed income, Social Security's benefit with earnings calculation process works as follows:

- Step 1: List your earned income

- Step 2: List your deemed income

- Step 3: List your unearned income

- Step 4: Subtract income the Social Security does not count

- Step 5: The result is your "Countable Income" which is the income the Social Security counts against the SSI Federal Benefit Rate (the maximum federal SSI monthly amount which is $750 for an individual).

- Step 6: List the SSI federal benefit rate

- Step 7: Subtract your countable income

- Step 8: The result is your monthly SSI amount

Earnings Offset Examples

Earnings Offset Examples

Example 1 - Earned and Unearned Income

- Step 1: $165 (Part-time work which is earned income)

- Step 2: $0

- Step 3: $200 (Monthly money given to you by your mother which is unearned income)

- Step 4: -$20 (Unearned income not counted)

- Step 4: -$90 [Half of unearned income over $20 not counted: $200-$20 = $180/2 = $90]

- Step 4: -$65 (Earned income not counted)

- Step 5: =$190 (Countable income: earned income is $165-$65 = $100, unearned income is $200-$20-$90 = $90, and the earned and unearned income total is $100+$90 = $190)

- Step 6: $967 (SSI Federal benefit rate in 2025)

- Step 7: -$190 (Countable income)

- Step 8: =$777 (Your monthly SSI amount: $967-$190 = $777)

Example 2 - Deemed and Unearned Income

- Step 1: $0

- Step 2: $425 (Your spouse works which is deemed income)

- Step 3: $500 (You receive free rent from your parents which is unearned income)

- Step 4: -$20 (Unearned income not counted)

- Step 4: -$240 (Half of unearned income over $20 not counted: $500-$20 = $480/2 = $240)

- Step 5: =$665 (Countale income: deemed income is $425, unearned income is $500-$20-$240 = $240, and the earned and unearned income total is $425+$240 = $665)

- Step 6: $967 (SSI Federal benefit rate in 2025)

- Step 7: -$665 (Countable income)

- Step 8: =$302 (Your monthly SSI amount: $967-$665 = $302)

Example 3 - Unearned Income

- Step 1: $0

- Step 2: $0

- Step 3: $2,420 (You receive VA benefits which is unearned income)

- Step 4: -$20 (Unearned income not counted)

- Step 4: -$1,200 (Half of unearned income not counted: $2,420-$20 = $2,400/2 = $1,200)

- Step 5: =$1,200 (Countable income: total unearned income is $1,200)

- Step 6: $967 (SSI Federal benefit rate)

- Step 7: -$1,200 (Countable income)

- Step 8: =-$233 (You will receive no SSI benefits as there is a total offset)

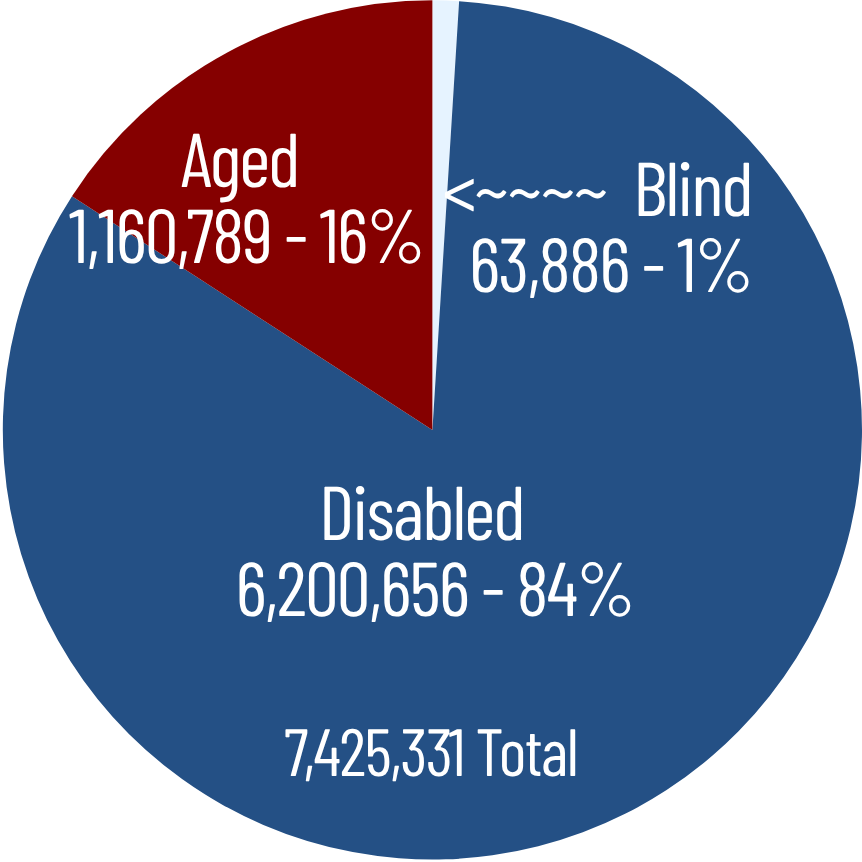

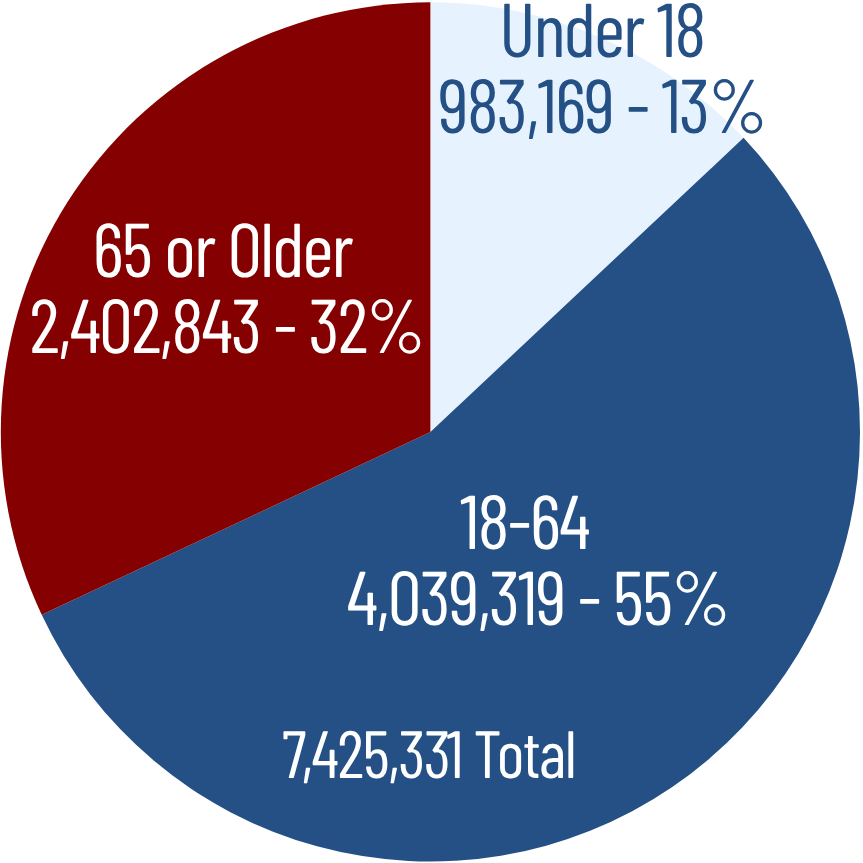

2023 SSA Supplemental Security Record

2023 SSA Supplemental Security Record

Non-Citizen Eligibility

Non-Citizen Eligibility

Overview - If you are neither citizen nor a national, you must 1) be a "qualified alien," and 2) meet a "condition" to be eligible for benefits.

Qualified Aliens - There are seven categories of qualified aliens as follows:

- You are a Lawfully Admitted for Permanent Residence (LAPR) in the U.S. (green card holder), which includes an "Amerasian immigrant" as defined in P.L. 100-202, with a class of admission AM-1 through AM-8;

- You are granted conditional entry under Section 203(a)(7) of the Immigration and Nationality Act (INA) in effect before April 1, 1980;

- You are paroled into the U.S. under Section 212(d)(5) of the INA for at least one year;

- You are a refugee admitted to the U.S. under Section 207 of the INA;

- You are granted asylum under Section 208 of the INA;

- Your deportation is being withheld under Section 243(h) of the INA, as in effect before April 1, 1997, or removal is being withheld under Section 241(b)(3) of the INA; or

- You are a "Cuban and Haitian entrant" as defined in Section 501(e) of the Refugee Education Assistance Act of 1980 or in a status that is to be treated as a "Cuban/ Haitian entrant" for SSI purposes.

Conditions - If you meet one of the seven categories of qualified aliens, you must also meet one of the following conditions:

- You were receiving SSI and lawfully residing in the U.S. on August 22, 1996;

- You are LAPR with 40 qualifying quarters of work;

- You are a U.S. Armed Forces active duty member, an honorably discharged veteran, or a discharged veteran whose discharge was not honorable because you are an alien (this condition may apply to the spouse, widow(er), or dependent child);

- You were lawfully residing in the U.S. on August 22, 1996, and you are blind or disabled; or

- You may receive SSI for a maximum of seven years from the date DHS granted you immigration status in one of the following categories, and the status was granted within seven years of filing for SSI:

- You are a refugee under Section 207 of the INA;

- You are an asylee under Section 208 of the INA;

- You are an alien whose deportation was withheld under Section 243(h) of the INA or whose removal was withheld under Section 241(b)(3) of the INA;

- You are a "Cuban or Haitian entrant" under Section 501(e) of the Refugee Education Assistance Act of 1980 or in a status that is to be treated as a "Cuban/ Haitian entrant" for SSI purposes; or

- You are an "Amerasian immigrant" pursuant to P.L. 100-202, with a class of admission of AM-1 through AM-8.

Additional Categories

Additional Categories

Two additional categories of aliens may be eligible as follows:

- Victims of Severe Forms of Human Trafficking - you may be eligible for SSI under certain circumstances if the Department of Health and Human Services' Office of Refugee Resettlement and the Department of Homeland Security determines that you meet the requirements of the Trafficking Victims Protection Act of 2000; and

- Iraqi/Afghan Special Immigrants: you may also qualify for SSI for a period of seven years if you are admitted to the U.S.

Native American Exception

Native American Exception

Two categories of non-citizens may be eligible for SSI and are not subject to the August 22, 1996, Law for Certain Non-Citizens include:

- American Native Americans in Canada who were admitted to the United States under Section 289 of the INA; or

- Non-citizen members of a federally recognized Native American tribe who fall under Section 4(e) of the Indian Self-Determination and Education Assistance Act.

You Deserve A Qualified And Experienced Disability Lawyer

"Emails and texts are impressive modern tools that allow attorneys, staff, and clients to communicate easily and more frequently. Hence, both should be used whenever possible."

How To Be A Super Lawyer. Courtesy. Take action. Have integrity. Explain. Always think ahead. Seek Justice. Honor. Always be committed. Thoughtfulness. Be fair. Win, win, win, win.