Adult Social Security Disability Benefits - SSDI & SSI

What Kinds of Disability Benefits Can I Get?

What Kinds of Disability Benefits Can I Get?

There are two different Social Security disability programs: Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). If Social Security finds you disabled with either program, you are entitled to the following four benefits:

- Monthly payments,

- Back pay,

- Medicare/Medicaid (medical insurance), and

- Earnings freeze.

Tip. If you are entitled to SSDI benefits, you may have family members entitled to Family's SSDI Disability Benefits.

Monthly Amount

Monthly Amount

SSDI

SSDI

Your SSDI monthly benefit amount is based on how much you have paid in lifetime Social Security taxes. The average SSDI monthly amount in 2025 is $1,580. THe maximum is $4,018 maximum. If you want to know your monthly benefit amount, you can call Social Security and request a written benefit estimate which Social Security will send to you.

SSI

SSI

The federal SSI monthly benefit amount in 2025 is $967 per individual and $1,450 per couple and $484 for an "essential person" which are found here - Federal Supplemental Security Income (SSI) Amount. All but five states/territories (AZ, MS, ND, WV, Mariana Islands) supplement the federal amount depending on the nature of your medical impairment (usually an additional $25-$150). An "essential person" is someone who lives with and provides essential care to an SSI recipient, particularly when that care is necessary for the recipient's well-being. An "essential person" is nearly always a parent or grandparent for a child, or a spouse or caretaker for an adult.

Back Pay Amount

Back Pay Amount

SSDI Back Pay

SSDI Back Pay

Overview. SSDI back pay is your accrued monthly benefit amount. It starts, at the earliest, from whichever date is later - 1) 17 months before the date you apply for benefits, or 2) your alleged onset date (the date you allege disability) and ending the date you are finally paid benefits. However, Social Security imposes a five full-month waiting period on you which means your benefits start five full-months after either of the two above starting dates. Your SSDI back pay is paid in one lump sum.

Back Pay Amount Examples

Back Pay Amount Examples

Example 1 - You apply for SSDI benefits on June 16, 2025. You allege disability beginning March 3, 2022 (your alleged onset date). Social Security finds you disabled as of March 3, 2022. Your back pay period starts January 16, 2024 (17 months before you applied for benefits). Then Social Security imposes its five full-month waiting period. That is, it counts away five full months. You will not be paid for January 2020 because it is not a full month. Your five full-month waiting period consists of February, March, April, May, and June. Your back pay will begin July 1, 2024.

Example 2 - You apply for SSDI benefits on November 21, 2024. You allege disability beginning April 7, 2024 (your alleged onset date). Social Security finds you disabled beginning April 7, 2024. The earliest date you can receive back pay is April 7, 2024 (the date you allege disability). Then Social Security imposes its five full-month waiting period. April does not count because it is not a full month. Social Security counts away five full months - May, June, July, August, and September. Your back pay begins October 1, 2024.

SSI Back Pay

SSI Back Pay

SSI back pay is the accrued monthly benefit amount starting, at the earliest, from the date you apply for benefits and ending the date you are finally paid. If your back pay amount is low, it will be paid in one lump sum. If your back pay amount is high, it is generally paid in two or three installments each six months apart.

Medical Insurance

Medical Insurance

Medicare

Medicare

Medicare is medical insurance. Medicare is a national medical insurance program administered by the United States government with private insurance companies. Medicare requires that you pay monthly premiums and co-pays. If you receive SSDI, you will receive Medicare. However, you must wait 24 months (a 24-month waiting period) after your five full-month waiting period to receive Medicare. That is correct, Medicare will not begin for 24 months until after your five full-month waiting period. So, to take example 1 above, the five full-month waiting period ended July 1, 2024. Therefore, Medicare would begin July 1, 2026. In example 2 above, the five full-month waiting period ended October 1, 2024. Therefore, Medicare would begin October 1, 2026.

Medicaid

Medicaid

Medicaid is medical insurance. If you receive SSI, you will receive Medicaid which is a medical insurance program administered by both the United States government and individual states with private insurance companies. There are usually no costs to the recipient.

Earnings Freeze

Earnings Freeze

The earnings freeze increases your monthly disability and retirement benefit amount.

The amount of benefits you receive for both disability benefits and retirement benefits is based on how much money you earned, and how much Social Security tax you paid, in each year of your adult life for your whole adult life. The more you earned and the more taxes you paid in, the higher your monthly benefit amount. If you have years of no earnings or low earnings, these years, when calculated into the formula to determine your monthly amount, will reduce your monthly disability and retirement benefit amount. However, if your no earnings or low earnings years occurred because you were disabled and unable to work, Social Security will not include those no-earnings years when it calculates your monthly disability and retirement benefit; this is called the earnings freeze - your no or low earning disabled years are "frozen." As a result, these years are excluded from your benefit calculation, and your disability and retirement monthly benefit amount is higher. Your earnings freeze will begin the year you are found disabled and will end when you are no longer disabled or you retire whichever comes first.

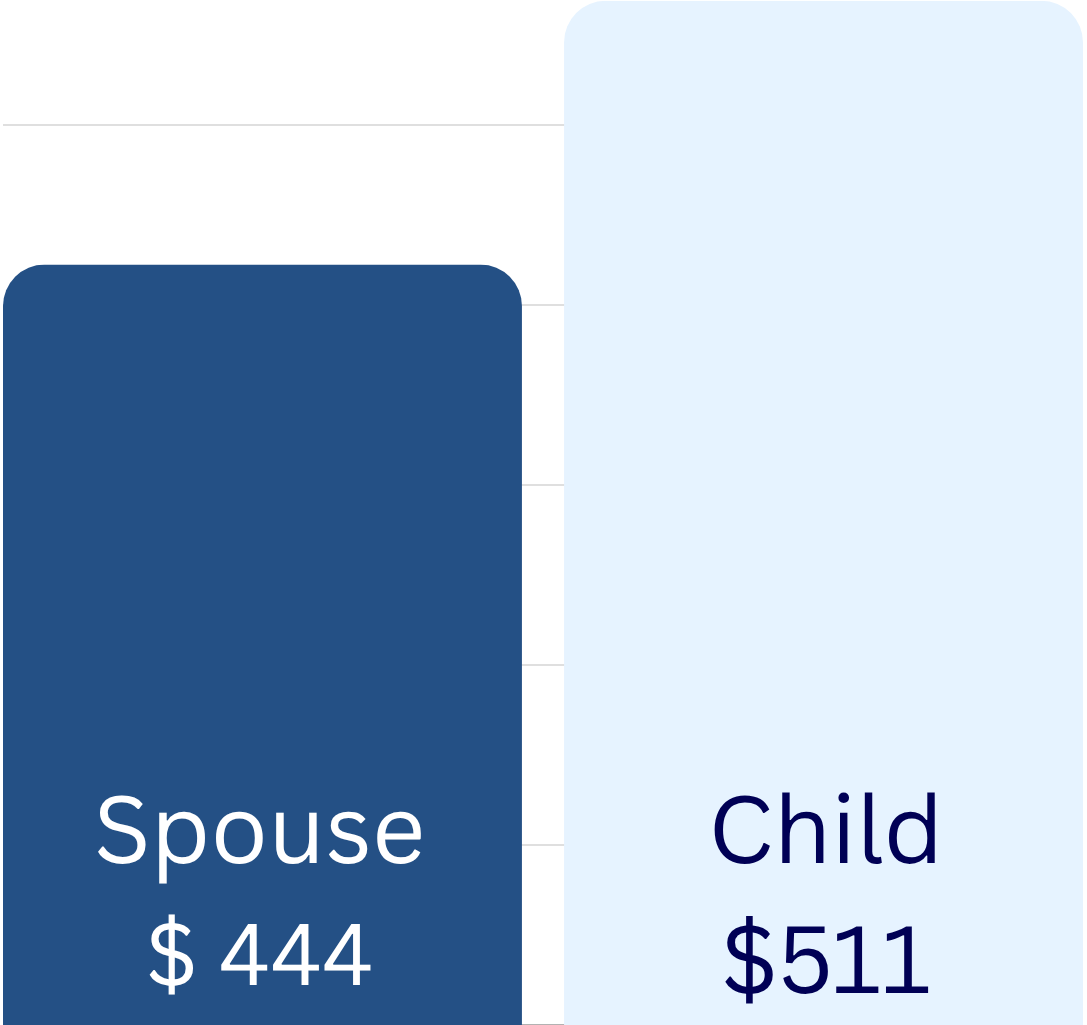

June 2025 SSA Monthly Statistical Snapshot

June 2025 SSA Monthly Statistical Snapshot

Payee

Payee

When Appointed

When Appointed

Social Security will require a payee if you or the family member who is receiving the family benefit (whoever is being paid) is physically or mentally incapable of managing the payments. A payee is most often required when there is a severe mental health impairment or a serious past or present issue with drug or alcohol abuse.

Who Appointed

Who Appointed

Social Security will give you notice of its intention to require a payee. You have a right to object to a payee. You also have the right to recommend your payee. If you object to a payee, you will need to do two things. First, you need to ask Social Security why it requires a payee. Second, you can explain to Social Security why its reasoning is incorrect and that you do not need a payee which you can do in writing or verbally with a Social Security employee. Social Security may ask you to produce information to support your position that a payee is not needed. Social Security has established its payee preferences: 20 CFR 404.2021. If a payee is required, and you do not have someone who can serve as your payee, there are organizations/businesses that can serve as a payee for a fee.

Duties

Duties

A payee is generally required to follow the following four basic rules:

- The payee must always act in your best interest;

- The payee must use your benefit payments in the following order (satisfying each step fully before satisfying an additional step);

- The payee must satisfy your maintenance defined as food, shelter, clothing, medical and personal care;

- The payee must satisfy your legal dependents;

- The payee must satisfy your creditor's that arose after the first month's payments;

- Conserve and invest any remaining amount not utilized to satisfy any of the aforementioned needs; and

- The payee must submit written accounts to Social Security concerning managing of the benefit payments.

Any misuse of the benefit payment may result in payee liability, selecting a new payee, or stopping the benefit payments.

Hire A Good Attorney And Get Your Benefits And Your Backpay

"The very best attorneys fully explain what Social Security disability benefits will be awarded, how long it will benefit process take, and then ensure the benefits are accurate."