Your Family's Social Security Disability Benefits - SSDI

Benefits For Your Family Depend On What Type Of Disability Benefits You Receive

Benefits For Your Family Depend On What Type Of Disability Benefits You Receive

Supplemental Security Income (SSI)

Supplemental Security Income (SSI)

If you receive SSI disability benefits only, you are not entitled to additional benefits for your family members.

Social Security Disability Insurance (SSDI)

Social Security Disability Insurance (SSDI)

If you receive SSDI disability benefits, certain family members can also be paid Social Security benefits:

- Child/children (subject to a "family maximum" discussed below),

- Spouse (subject to a "family maximum" discussed below),

- Divorced Spouse,

- Mother and father benefits as a surviving spouse,

- Mother and father benefits as a surviving spouse, and

- Widow/widower.

Your dependent family members are entitled to monthly payments and back pay. They are not entitled to Medicare or Medicaid (medical insurance).

All benefits paid to family memebers do not reduce your SSDI month benefit or backpay amount.

Children's Benefits

Children's Benefits

Eligibility Criteria

Eligibility Criteria

Your child can receive monthly SSDI benefits if you are eligible for monthly SSDI benefits and your child satisfies the following:

- Your child is dependent on you for financial support;

- Your child is, in fact, your child;

- Your child is under age 18, your child is 18 but younger than 19 and is a full-time student in an elementary or secondary school (grade 12 or below), or your child is 18 or older and has a disability that began before they became 22 years old ("adult child" benefits);

- Your child is unmarried; and

- You file an application for your child.

Benefit Amount

Benefit Amount

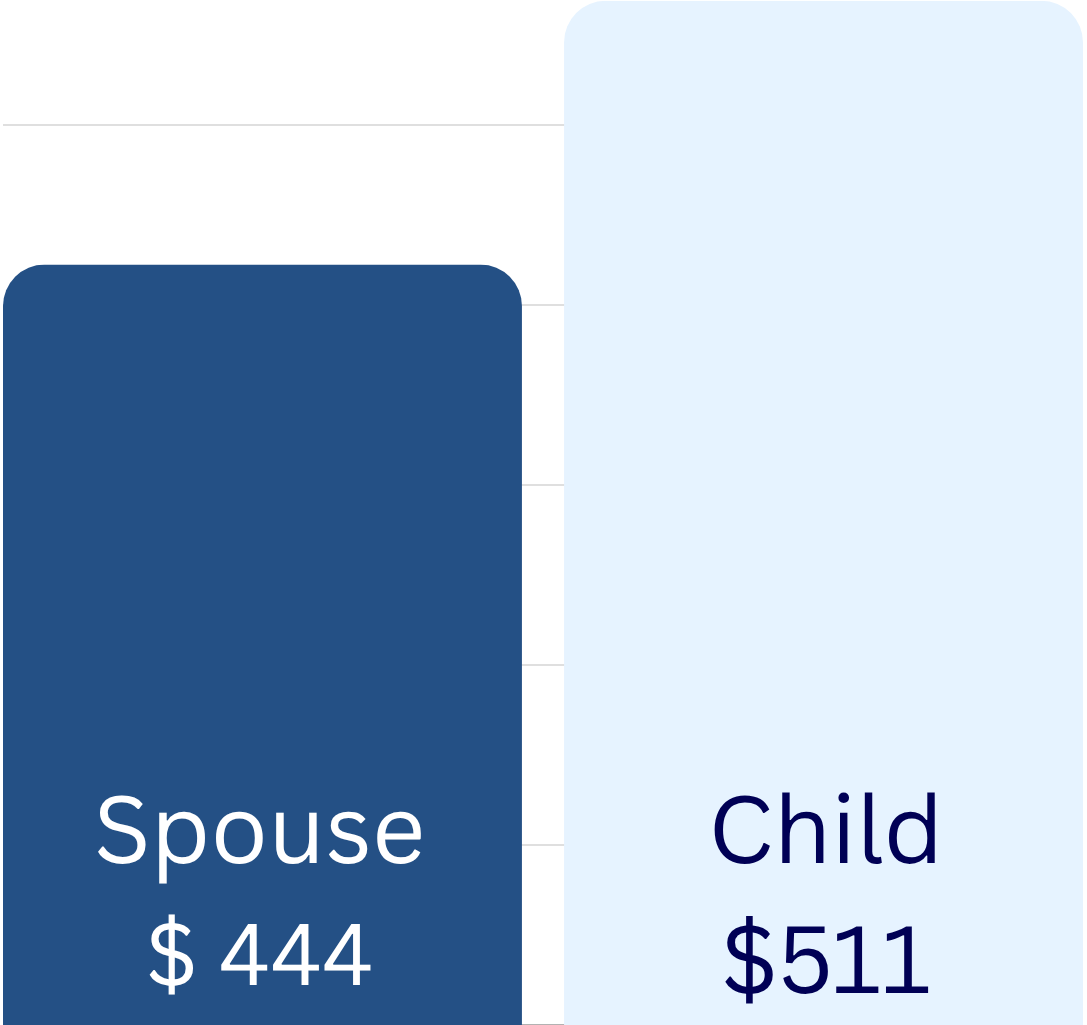

Your child's SSDI monthly benefit amount is 50% of your SSDI monthly benefit amount. If your child is under 18, back pay and monthly benefits are paid to the parent who has greater physical custody of the child. If you have equal physical custody of your child with the other parent, Social Security will choose one parent as the payee. Child's benefits may offset child support obligations, if any, depending on your state.

If your child is over 18, back pay and monthly benefits are paid to the "adult child."

If you are deceased, your child's SSDI monthly benefit amount is 75% of your SSDI monthly benefit amount.

Benefits paid to dependent a child/children do not reduce your benefit amount.

Benefits paid to you and your child/children are subject to a "family maximum" amount discussed below.

Spouse's Benefits

Spouse's Benefits

Eligibility Criteria

Eligibility Criteria

Your spouse can receive monthly SSDI benefits if you are eligible for monthly SSDI benefits and your spouse satisfies the criteria 1 through 5:

- Your spouse is, in fact, your spouse.

- One of the following -

- Your marriage has lasted one year;

- You and your spouse are the natural parents of a child; or

- In the month before the your spouse married you, your spouse was entitled to, or if he/she had applied and been old enough they could have been entitled to, any of these benefits or payments: Wife's, husband's, widow's, widower's, or parent's benefits; disabled child's benefits; or annuity payments under the Railroad Retirement Act for widows, widowers, parents, or children age 18 or older.

- One of the following -

- Your spouse is 62 or older, or

- Your spouse has your child in his/her care (or both you and your spouse are caring for your child) and the child is receiving Social Security benefits because you are disabled and the child is either under age 16 or disabled.

- Your spouse is not entitled to a higher benefit amount based upon her or someone else' Social Security record (in other words, if your spouse is entitled to a larger benefit amount based on his or her own or someone else's work record, they will get that benefit amount instead).

- Your spouse applies.

Benefit Amount

Benefit Amount

Your spouse's SSDI monthly benefit amount is 50% of your SSDI monthly benefit amount. The spouse is paid the benefit amount.

Benefits paid to your spouse do not reduce your benefit amount.

Benefits paid to you and your spouse are subject to a "family maximum" amount discussed below.

June 2025 SSA Monthly Statistical Snapshot

June 2025 SSA Monthly Statistical Snapshot

Family Maximum Benefit Amount

Family Maximum Benefit Amount

Overview

Overview

You are subject to a family maximum monthly benefit amount payable on your work record. This is the maximum monthly benefits amount that can be paid to you and your child/children and spouse. The family maximum only applies to you, your child/children, and your spouse). Your SSDI family maximum monthly benefit amount is 50 to 88% more than your monthly benefit amount. If you have multiple qualifying family members so that your family maximum is reached, they split the family benefit amount equally.

Family Maximum Examples

Family Maximum Examples

Example 1. Your SSDI monthly disability benefit amount is $1,200 per month. Your SSDI monthly family maximum amount is $1,800 (50% more than your monthly benefit amount). You are married, and your spouse works. You have one child who is not disabled and under age 16. You will be paid your monthly benefit amount of $1,200, and you will be paid the extra $600 - $300 for your wife and $300 for your one child. Your family members will split the extra $600 equally. When your child becomes older than 16 and is not disabled, you will continue to receive $1,200 per month for yourself, and $600 will be paid to you for your spouse.

Example 2. Your SSDI monthly disability benefit amount is $1,800 per month. Your SSDI monthly family maximum amount is $2,700 (50% more than your monthly benefit amount). You are divorced, and your spouse is under age 62. You have two chidren who are not disabled and both are under age 16. Your spouse has primary custody of the two children. You will be paid your monthly benefit amount of $1,600. Your spouse will be paid the extra $900 - $450 for your first child, and $450 for your second child.

Example 3. Your SSDI monthly disability benefit amount is $1,500 per month. Your SSDI monthly family maximum amount is $2,250 (50% more than your monthly benefit amount). You are either single or divorced and your divorced spouse is under age 62. You have no chidren. You will be paid your monthly benefit amount of $1,500.

Divorced Spouse Benefits

Divorced Spouse Benefits

Eligibility Criteria

Eligibility Criteria

Your divorced spouse can receive monthly SSDI benefits if you are eligible for monthly SSDI benefits and your divorced spouse satisfies the following seven criteria:

- Divorced Spouse is, in fact, your divorced spouse and -

- Divorced Spouse was validly married to you under state law (this includes common law marriage) or you were deemed to be validly married by Social Security, and

- Divorced Spouse was married to you for at least ten years immediately before your divorce became final;

- Divorced Spouse is not married;

- Divorced Spouse is age 62 or older;

- Divorced Spouse has been divorced from you for at least 2 years;

- Divorced Spouse is not entitled to a higher benefit amount based upon her or someone else' Social Security record (in other words, if your spouse is entitled to a larger benefit amount based on his or her own or someone else's work record, own, they will get that benefit amount instead);

- Your ex-spouse applies.

Benefit Amount

Benefit Amount

Your divorced spouse's monthly benefit amount is 50% of your monthly benefit amount. The divorced spouse's benefit is paid to the divorced spouse.

The divorced spouse's benefit amount does not reduce your benefit amount.

Mother and Father Benefits as a Surviving Spouse

Mother and Father Benefits as a Surviving Spouse

Eligibility Criteria

Eligibility Criteria

The surviving mother or father of an insured child can receive monthly benefits after the insured's death if the followng criteria is met:

- Mother or father is the widow/widower of the insured;

- Mother or father is not entitled to a widow/widower's benefit or old-age benefit amount that is larger that the mother/father benefit amount (you will get the larger amount);

- Mother or father has in their care the insured's child who is under age 16 or disabled, and is entitled to child's benefits on the insured person's work record;

- Mother or father is unmarried; and

- Mother or father applies.

Benefit Amount

Benefit Amount

A surviving mother or father's monthly benefit amount is 75 percent of the deceased spouse's benefit amount.

Mother or Father Benefits as a Surviving Divorced Spouse

Mother or Father Benefits as a Surviving Divorced Spouse

Eligibility

Eligibility

The surviving divorced mother or father of an insured's child can receive Social Secrity benefits after the insured's death if the following critiera is met:

- Mother or father were validly married to the insured under state law;

- Mother or father is actually the mother/father of the insured's child (natural or adopted);

- Mother or father is not entitled to a widow/widower's benefit or old-age benefit amount that is larger that the mother/father benefit amount (you will get the larger amount);

- Mother or father is unmarried;

- Mother or father has in their care the insured's child who is under age 16 or disabled, and is entitled to child's benefits on the insured person's work record; and

- Mother or father applies.

Benefit Amount

Benefit Amount

A surviving divorced mother or father's monthly benefit amount is 75 percent of the deceased spouse's benefit amount.

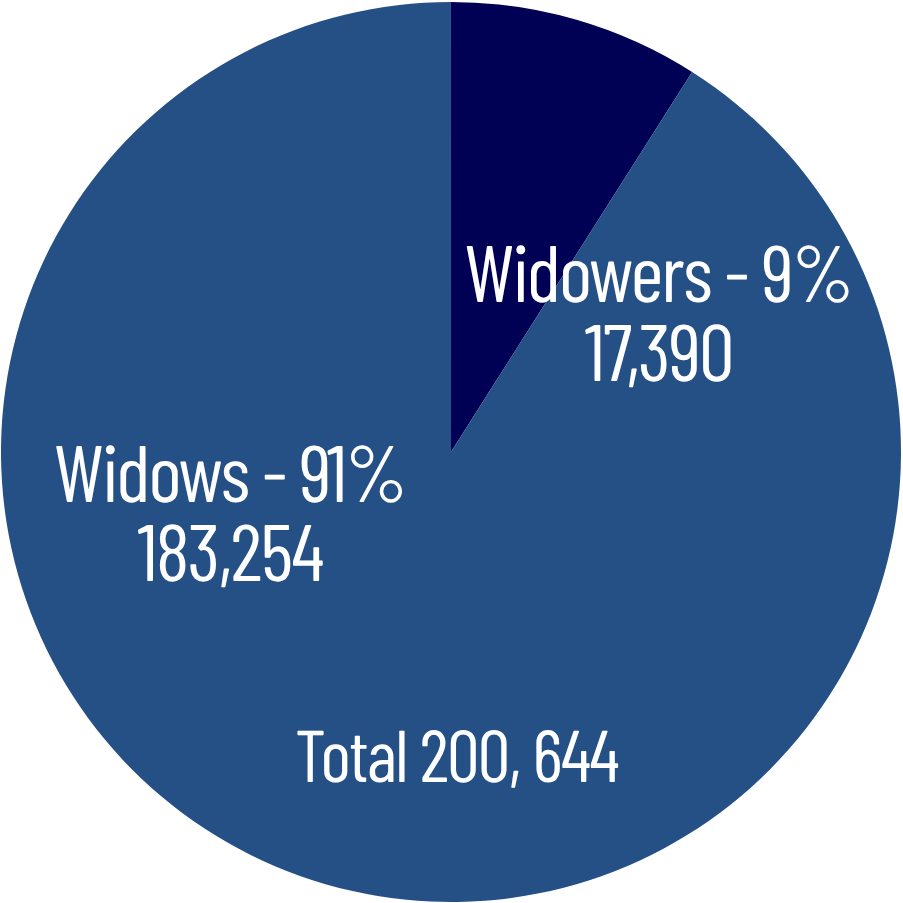

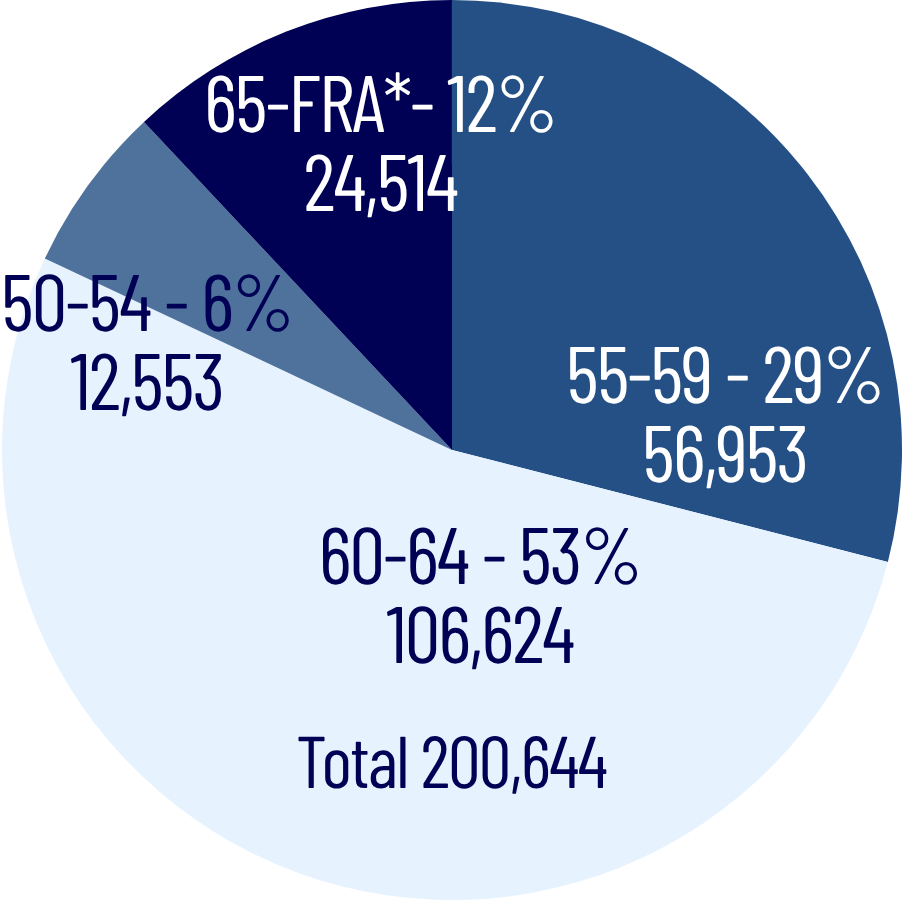

Widow & Widower Benefits

Widow & Widower Benefits

Eligibility

Eligibility

Widow or widower can receive Social Security disability benefits if they satisfy the following six general criteria:

- Widow or widower and the deceased spouse were married for at least nine months, but the widow or widower do not have to be married for at least nine months if one the follow three criteria are met -

- Widow or widower and the deceased spouse share a child,

- Widow or widower's deceased spouse's death was an accident, or

- Widow or widower's deceased spouse died while in the line of active duty for the military;

- Widow or widower applies;

- Widow or widower is at least 60 years old, or at least 50 years old and have been determined disabled by Social Security (one cannot receive widows/widowers benefits if one is under age 50);

- Widow or widower's deceased spouse's Social Security benefit amount is more than the widow or widower's Social Security benefit (one cannot get both benefits, only the larger amount of the two amounts); and

- Widow or widower is unmarried but they can be married if one the follow three criteria are met -

- Widow or widower remarries after age 60;

- Widow or widower is currently age 60, was remarried between age 50 and 60, and was receiving widow/widower benefits at the time of the remarriage; or

- Widow or widower is at least age 50 and not yet 60, was remarried after turning age 50, and was receiving Social Security benefits at the time of the remarriage.

Widow & Widower Amount

Widow & Widower Amount

Your widow/widower's Social Security monthly benefit amount is based on the deceased spouse's work record. However, if the widow/widower's monthly benefit amount is higher than that of the deceased spouse, the widow/widower will not receive widow/widower's benefits and will instead be paid on their own work record. However, this situation is rare. The widow/widower's Social Security monthly benefit amount is as follows:

- The widow/widower is younger than age 61 - 71.5% of the deceased spouse's benefit amount,

- The widow/widower is age 61-63 - 75% of the deceased spouse's benefit amount,

- The widow/widower is age 63 - 80% of the deceased spouse's benefit amount,

- The widow/widower is age 65 - 90% of the deceased spouse's benefit amount, or

- The widow/widower is at full retirement age - 100% of the deceased spouse's benefit amount.

Full retirement is on a sliding scale from. It can be viewed here - Full Retirement Age

Can I Receive Widow/Widower's Benefits From More than One Deceased Spouse?

Can I Receive Widow/Widower's Benefits From More than One Deceased Spouse?

Yes. One can receive widow/widower's Social Security monthly benefits from more than one deceased spouse if each of the deceased spouse's is insured, and one meets the eligibilty criteria for each spouse. If one receive widows/widower benefits for more than one deceased spouse, one will receive 100% of each deceased spouse's Social Security benefit amount; each amount wil not be reduced.

Can I Receive Widow/Widower's Benefits From One Spouse and Divorced Widow/Widow's Benefits From Another Spouse?

Can I Receive Widow/Widower's Benefits From One Spouse and Divorced Widow/Widow's Benefits From Another Spouse?

No. A widow/widower can only receive the larger of the two benefits.

Amount Decreases

Amount Decreases

A widow/widower's monthly benefit will be reduced if the deceased spouse chose to receive old-age benefits before reaching full retirement age. If so, your widow/widower's benefit will be reduced to the amount your deceased spouse would be receiving if alive or 82.5 percent of their monthly Social Security benefit amount, whichever is larger.

Amount Increases

Amount Increases

Your widow/widower's monthly benefit may be increased if your deceased spouse 1) chose to delay filing for Social Security benefits, 2) requested voluntary suspension of their benefits, or 3) worked before the year 2000 after they reached full retirement age.

Spouse Death Before 62

Spouse Death Before 62

If the widow or widower died before age 62, the Social Security may use a special computation to determine the widow/widower's monthly benefit amount.

2023 Report on the SSDI Program

2023 Report on the SSDI Program

Earnings Offset

Earnings Offset

Overview

Overview

If you are disabled, and you are getting child or spouse SSDI monthly dependent's benefits, and your child or spouse works, the monthly child or spouse dependent's benefits amount will be reduced if your child or spouse earns a certain amount of income. This is called the earnings offset. Again, the child or spouse's monthly disability benefit amount will be reduced; your monthly disability benefit amount will not be reduced. In 2018, a child or spouse can work and make $17,040 per year with no reduction in SSDI monthly dependent's benefits. Social Security will deduct $1 from your family member's benefits for each $2 they earn above $17,040 (half).

Earnings Offset Examples

Earnings Offset Examples

Example 1. You receive $1,200 per month in SSDI disability benefits. Your family maximum is $1,800 per month (50% more than your SSDI benefit amount). Your two children and your wife are receiving SSDI dependent's benefits on your work record, and they share the $600 family dependent amount equally - $200 each. Your wife begins working earning $20,000 in 2018. Social Security will deduct $1 for each $2 your wife earns above $17,040. Your wife earns $2,960 above $17,040 ($20,000 - $17,040 = $2,960). Social Security will deduct $1,480 from your wife's benefit amount ($1,480 is half of $2,960). Your wife was receiving SSDI dependent's benefits of $2,400 per year ($200 per month x 12 months), and $2,400 minus $1,480 is $920. Since your wife is now working, Social Security will pay your wife $920 a year, or $76 per month ($920 / 12 months). You are still entitled to $600 in SSDI family dependent's benefits (your family maximum). Since your wife starting working, your children will get $524 per month ($600 family maximum - $76 in SSDI dependent spouse's benefits). Child one will now receive $262 per month (half of $524). Child two will receive $262 per month (half of $524).

Example 2. You receive $1,200 per month in SSDI disability benefits. Your family maximum is $1,800 per month (50% more than your SSDI benefit amount). Your three children and your wife are receiving SSDI dependent's benefits on your work record, and they share the $600 family SSDI dependent amount equally - $150 each. Your wife begins working earning $40,000 in 2018. Social Security will deduct $1 for each $2 your wife earns above $17,040. Your wife earned $22,960 above $17,040 ($40,000 - $17,040 = $22,960). Therefore, Social Security will deduct $11,480 from your wife's SSDI benefit amount ($11,480 is half of $22,960). Your wife was receiving spouse's SSDI dependent's benefits of $2,400 per year ($200 per month x 12 months), and $2,400 minus $11,480 is $0. Social Security will no longer pay your wife SSDI dependent's benefits. Your oldest child begins working part-time and earns $4,000 in 2018. Because your child made less than $17,040, Social Security will not deduct any amount from your oldest child's dependent SSDI benefit amount. You are still entitled to $600 in family SSDI dependent's benefits (your family maximum). Since your wife starting working, your three children will now share $600 per month, or $200 each.

Government Pension Offset

Government Pension Offset

If one is entitled to children's, spouse's, divorced spouse's, mother or father's, or widow/widower's benefits, and you receive a government pension for work that was not covered under the Social Security Act, your monthly Social Security benefits may be reduced because of that pension. This is a detailed discussion; for more information about a government pension offset is available here - CFR 404.408a.

Payee

Payee

If one is entitled to children's, spouse's, divorced spouse's, mother or father's, or widow or widower's benefits, you may be required to have a payee if you suffer a physical or mental impairment that renders you incapable of managing Social Security payments, or you currently engage or previously have engaged in significant drug or alcohol abuse. More about a payee is available here: Payee

Hire A Good Attorney And Get Your Benefits And Your Backpay

In a bad snowstorm, my college sidewalks were slick and perilous. As I walked, I came to a perfectly shoveled and salted sidewalk. I looked up. I was standing at the College of Law building.