Child Social Security Disability Benefits - SSDI & SSI

Four Types of Social Security Benefits for Children

Four Types of Social Security Benefits for Children

There are four types of Social Security benefits available for children or an "adult child":

- SSDI dependent's benefits, and

- SSDI survivor's benefits,

- SSDI "adult child" benefits, and

- SSI disability benefits.

Type 1 - SSDI Dependent Benefits

Type 1 - SSDI Dependent Benefits

Dependent child benefits are discussed here - Dependent Child Benefits.

Know To Win

- Non-Medical Criteria

- Disability Criteria

- Medical Conditions

- Functional Limitations

- Submit Winning Evidence

Type 2 - Survivor's Benefits

Type 2 - Survivor's Benefits

Benefits Available. There are three benefits available if a child is eligibile for Survivor's benefits:

- Monthly benefits;

- Back pay; and

- Medicare (health insurance);

Monthly Benefits and Back Pay. Monthly benefits and back pay are paid to the custodian of the child - usually this is the surviving parent, but this may be another family member, foster parent, or institution. Monthly benefits are 75% of the deceased parent's primary insurance amount (this is an amount calculated by Social Security based on the deceased parent's work record). Monthly benefits and back pay benefits begin the month of the benefit application. Back pay is paid in one lump sum. Social Security prefers electronic bank deposit of benefits. It usually takes Social Security about 60-90 to start benefit payment after the applicant is approved. Benefits end when eligibility criteria is no longer met - Child Survivor's Eligibilty Criteria.

Type 3 - Disabled "Adult Child" (DAC) Benefits

Type 3 - Disabled "Adult Child" (DAC) Benefits

"Adult Child" benefits are as follows:

- Monthly benefits;

- Back pay;

- Medicaid (health insurance); and

- Earnings Freeze.

In an "adult child" case, the applicant is not a child, but rather an adult who can be eligible for SSDI benefits if they can prove they became disabled as a "child" - before age 22. Back pay is owed to the applicant six before the application date if the parent is retired or 12 months before the application date if the parent is deceased. Back pay is paid in one lump sum. Social Security prefers electronic bank deposit of benefits. It usually takes Social Security about 60-90 to start benefit payment after the applicant is approved. Benefits end when the recipient is no longer disabled.

Type 4 - SSI Child Disablility Benefits

Type 4 - SSI Child Disablility Benefits

Benefits Available. There are four benefits available if a child is disabled under SSI rules:

- Monthly benefits;

- Back pay;

- Medicaid (health insurance); and

- "Essential Person" benefits.

Monthly Benefits. The monthly benefit amount is the "Federal Benefit Rate." This amount increases every year, and the current amount in 2025 is $967. The "essential person" amount in 2025 is $484. Both amounts are found here - Federal Supplemental Security Income (SSI) Amount. All but five states/territories (AZ, MS, ND, WV, Mariana Islands) supplement the federal amount for the disabled child (usually an additional $25-$150).

An "essential person" is someone who lives with and provides essential care to an SSI eligible child, particularly when that care is necessary for the child's well-being. An "essential person" for a child is nearly always 1) a parent, 2) grandparent, 3) other family member, or 4) a caretaker.

The person or entity who has custody of the child is paid the child's SSI benefit amount and the backpay - and usually the "essential person" amount.

Social Security prefers electronic bank deposit of monthly benefits, "essential person" benefits, and backpay.

Generally, and this varies, Social Security starts monthly payments and "essential person" benefits about 60 days after the child is found disabled.

Back Pay. Back pay is owed from the date of the benefit application until the time Socal Security processes benefits and starts payment. Back pay is paid in three installments. The first backpay installment is usually paid anywhere from 30 days to 90 days after the first monthly amount is paid. The second backpay installment is paid six months after the first backpay installment and the third backpay installment is paid six months after the second backpay installment. The first and second backpay installments are three times the monthly amount - federal benefit rate. The third installment is the remaining balance of the backpay.

Back Pay Amount Examples

Back Pay Amount Examples

Example 1 - Your child is found disabled and is entitled to $18,000 in backpay. The monthly amount (federal benfit rate) is $967 per month. Both the first and second backpay installments will be $2,901 ($967 x 3). The third backpay installment will be $12,198 ($18,000 minus $2,901 minus $2,901).

Example 2 - Your child is found disabled and is entitled to $7,000 in backpay. The monthly amount (federal benfeit rate) is $967 per month. Both the first and second backpay installments will be $2,901 ($967 x 3). The third backpay installment will be $1,198 ($7,000 minus $2,901 minus $2,901).

Expedited Back Pay. You can request your child's first or second back pay installment be increased if you have debts or expenses related to the following:

- Food;

- Clothing;

- Shelter including utilitiy bills;

- Medical care;

- Car;

- Phone; or

- Computer.

You will need to call your local Social Security office. The agent will require you to draft and submit the following:

- A written explanation of your need for an increased installment;

- An accounting of your income (this may just be SSI benefits); and

- An accounting of your bils/expenses.

*It is important, as always, that you get the name and extension of the person you are speaking with.

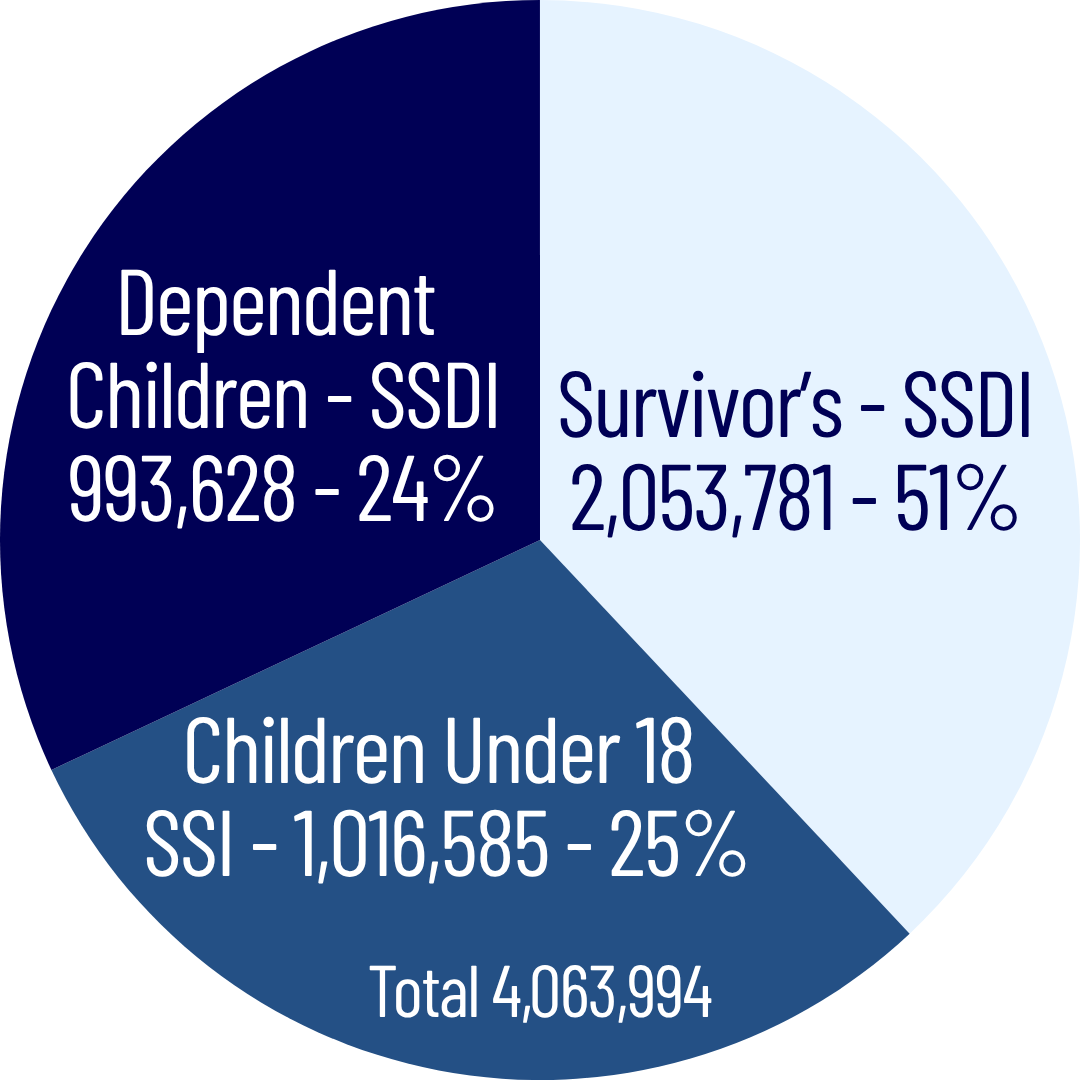

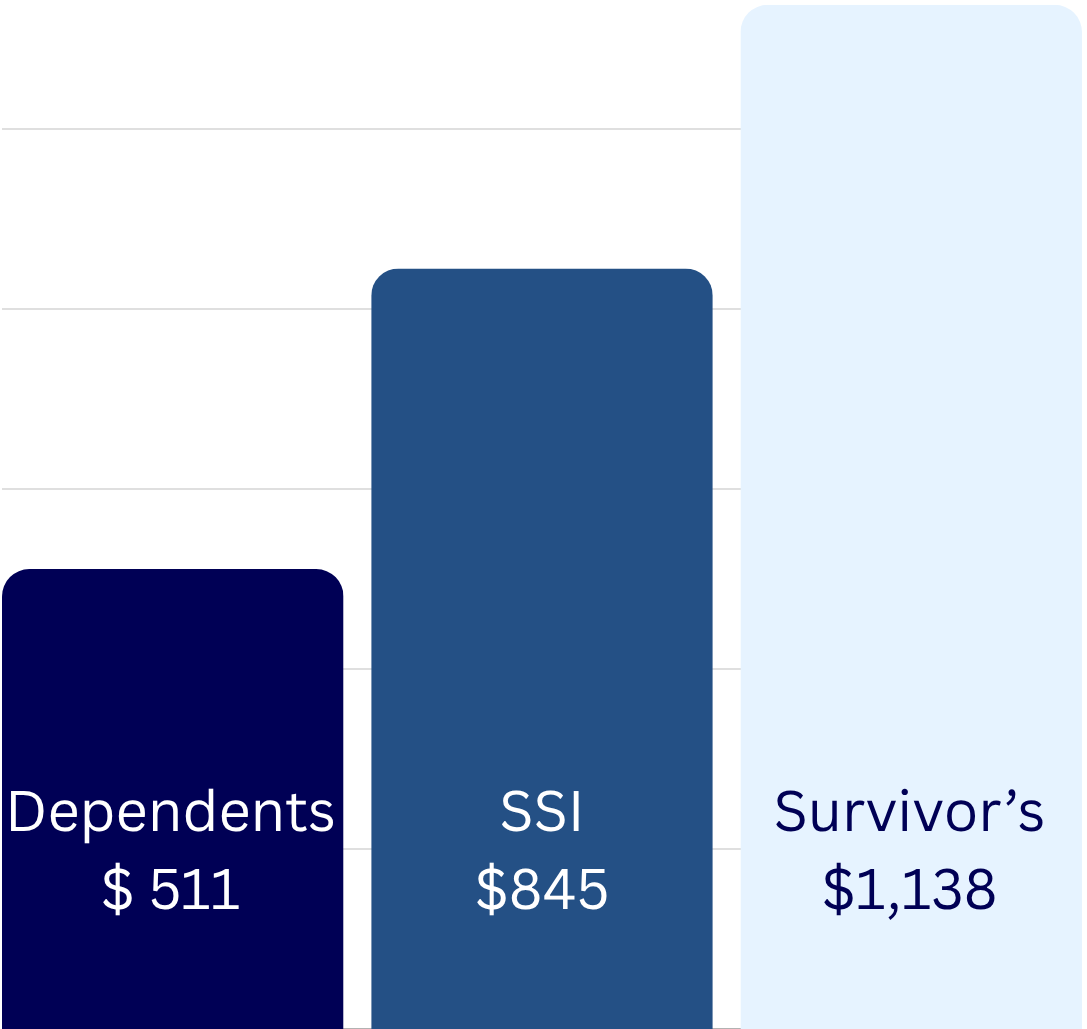

June 2025 SSA Monthly Statistical Snapshot

June 2025 SSA Monthly Statistical Snapshot

Do The Right Thing - Hire A Qualified Disability Attorney

- Step 1 - SGA

- Step 2 - Severe

- Step 3 - The Listings

How To Be A Great Lawyer. Fortitude. Confidence. Be passionate. Prudence. Have gratitude. Be neat. Live life with purpose. Know your client's needs. Have good character.